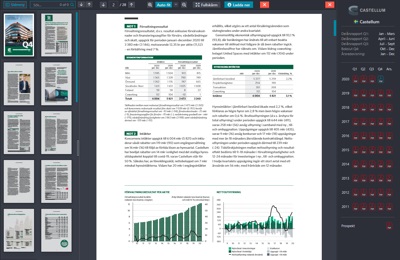

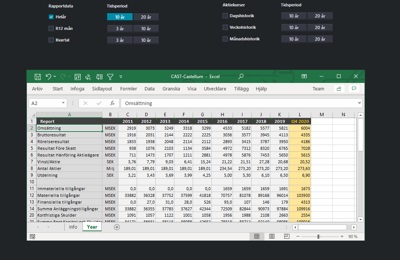

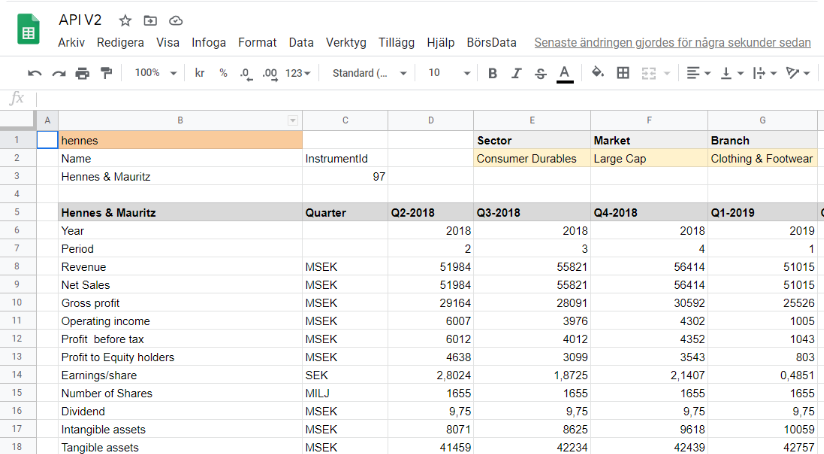

Ratios

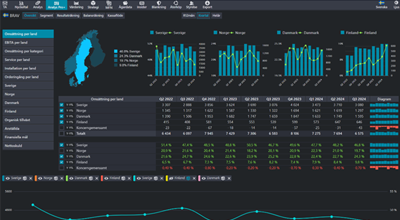

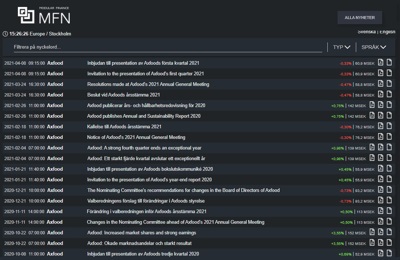

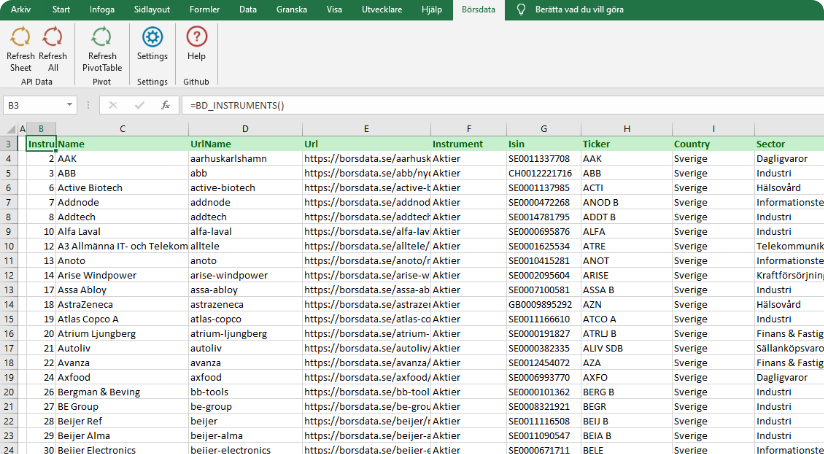

Analyze and find trends

Find the most common ratios in different categories and stock prices with up to 20 years of historical values. Analyze the average and growth ratios historically and compare it with other companies in the same industry.